Personal Insolvency for Dummies

Table of ContentsNot known Details About Bankrupt Melbourne Some Ideas on Bankruptcy Melbourne You Need To KnowBankruptcy Advice Melbourne Things To Know Before You BuyGetting The Bankruptcy Australia To WorkThe Facts About Bankruptcy Melbourne Uncovered

In some cases, where there is no equity in a property the trustee will allow you to retain it (for instance where your home loan is nearly the very same as, or more after that, the worth of your residence). Understand that the residence might still be sold later on if the worth increases and/or the home mortgage decreases.Your house might be taken as well as sold by the trustee at any kind of time, even after you have been released from insolvency. You may own building with one more individual such as your spouse, de facto partner or another family members member. if you state bankruptcy, the various other owner(s) will certainly be offered the alternative to get your share of the residential or commercial property from the trustee in personal bankruptcy - Bankruptcy.

Even deals which took place longer than 5 years ago can be challenged by the trustee if it can be shown you were trying to conceal riches from your lenders. There is no minimum quantity of debt required for you, a borrower, to present a request for bankruptcy. The Authorities Receiver can deny a borrower's petition if it assumes you: Would be able to pay the debts within a reasonable time; and also that either: You are resistant to pay one or all of his/her financial debts; or You have actually been formerly insolvent on a borrower's request at least 3 times or at least as soon as in the previous 5 years.

Unknown Facts About Bankruptcy Victoria

Jodhi declared bankruptcy on a $5,000 bank card financial obligation. 2 years later she inherited $40,000 when her grandpa died. Already the expense of annulling the personal bankruptcy (paying financial obligation consisting of interest, plus all the costs as well as costs of the trustee) was over $30,000, meaning that she got much less than $10,000 from her inheritance.

There are offenses linked with insolvency for which debtors may be prosecuted. There is likewise an offense associated to betting or harmful supposition, and an additional for sustaining credit scores which it was clear you can not pay.

If you are worried concerning any of these problems, talk to your monetary counsellor or obtain legal advice. Think about declaring bankruptcy if: You will certainly not have sufficient money to survive on if you make all the monthly additional info settlements you are called for to make to your lenders; You do not have assets that can be offered to pay off the financial debts (eg you lease your home and also your only various other property is an automobile worth under $8100, as at September 2020); You have actually consulted from a cost-free as well as independent financial counsellor and discovered various other choices; and You recognize and also can cope with the constraints that bankruptcy will bring now and also in the future.

Bankrupt Melbourne Things To Know Before You Get This

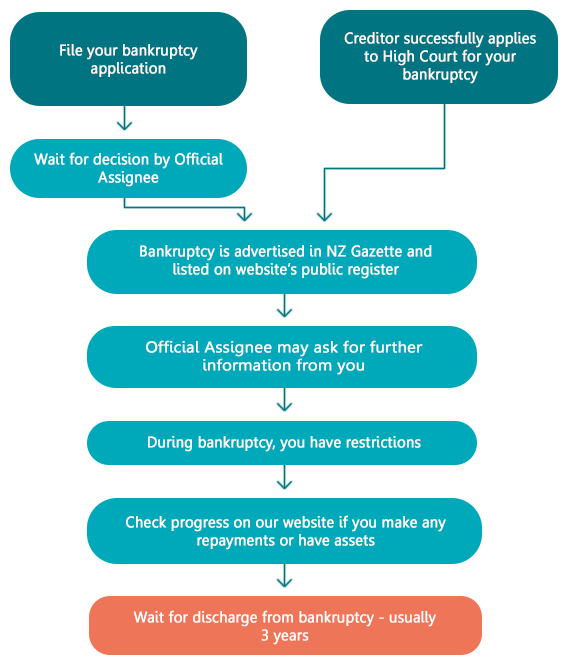

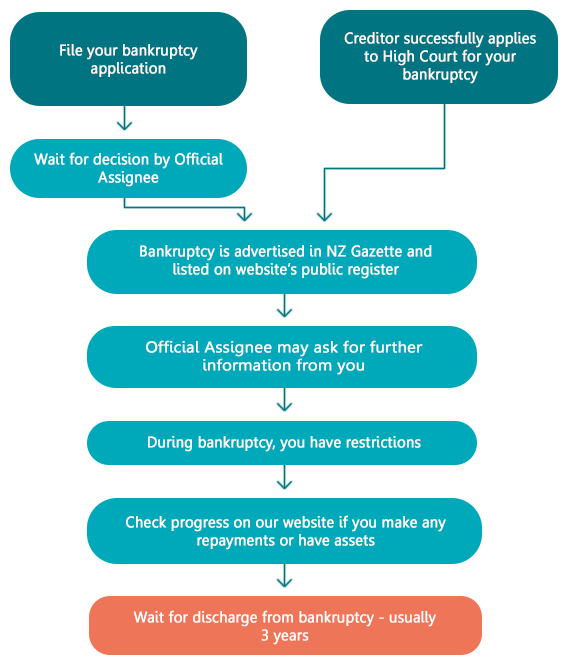

Action 2 A lot of personal bankruptcy applications currently have to be made online. Prior to you can declare insolvency by filling up in the Personal bankruptcy Type, be prepared to: Produce an account with AFSA before you can start; Validate your name and get in touch with details; Send files that show your identity.

A lot of economic therapy firms have accessibility to the paper variation of the Personal bankruptcy Form. Financial counsellors can aid you to complete the forms and recommend you on any type of issues you may be coming across concerning the insolvency process.

What Does Bankruptcy Australia Do?

Detail all your possessions hop over to here even if you may think the property is safeguarded in insolvency. You ought to call the National Financial obligation Hotline on 1800Â 007Â 007 if you need details suggestions on any of your debts.

Once you're adjudged bankrupt, financial institutions can't remain to chase you for any kind of financial debt consisted of in your bankruptcy. On discharge from your insolvency, you are released from the majority of the debts included in your bankruptcy and also you don't need to pay any type of even more of the superior quantity owed to the creditors included in your personal bankruptcy.

Get This Report about Personal Insolvency

contingent financial debts e. g. when you sign as guarantor for a pal's financing arrangement. You don't have to pay any type of money currently however you might have to settle the financial obligation in the future if your buddy doesn't pay. These financial debts are included in your insolvency, however will just be paid from earnings if the backup really emerges - Bankruptcy.

While you are launched from the financial debt on your discharge, the other individual is not. overseas financial debt Any type of financial debts owed to a creditor that is based overseas are included in the New Zealand personal bankruptcy. If you return published here to the nation where the liability was incurred then that lender is able to recoup any of the debt that you still owe in that country.

Guaranteed debt is excluded from personal bankruptcies because the creditor can retrieve the home if you do not pay, and also offer it to get their refund. If there's still cash owing after they've repossessed as well as marketed the property, that quantity ends up being an unsafe financial obligation and is then included in the insolvency.